Going Self-Employed in the Trade Industry

Reading time: 6 minutes

Why consider going self-employed in the trade?

Here are just a few reasons why becoming a self-employed tradesperson may be the best decision you make in your career:

1. You get to decide the hours that you work, as well as the holidays you take.

2. You will have full control about the clients you work for and the jobs you accept to complete.

3. How much you charge for each type of job you complete will be in your hands.

4. Jobs can be varied, as you will not just be plying your trade but also looking at project management, accounting and marketing as your business grows.

5. Certain costs, such as travel expenses and utility bills, can be deducted from your taxes, if these are incurred when completing a job.

6. You will earn a sense of achievement from starting your own business and hopefully seeing it develop into a successful venture.

Experience is key before you get started

As a self-employed tradesperson, you will need to be able to sell your skills and services to new clients – especially when you are first setting out on your own.

Build up your skills in your chosen trade, even if it is with some contract or temporary work. Also make sure to be taking pictures of your work, so that you have plenty of strong case studies to display your expertise to clients that you would like to work with.

An apprenticeship or qualifications in your trade is essential too. Printing these qualifications out and having them available to show to potential clients will give customers a piece of mind that you are a specialist in your field, as will any references from previous employers.

Try to use any of your spare time to enhance your general business skills as well. Knowing how to promote a business, aspects of HR and accounting are all sure to come in very handy as you grow your firm.

Types of business you can set up when self-employed

Once you are ready to become self-employed, you will have a decision to make about how your own business is structured. These are the main options to choose from, with GOV.UK links provided if you are interested to learn much more about each type:

-

Limited company – An option where your business will be a separate legal entity to you, with your role being as a director and shareholder.

You will benefit from a tax-efficient income and find plenty of ways to raise capital with this structure. However, take note that you will also need to pay corporation tax on any business profits and file annual accounts.

-

Sole trader – An option where you alone will run your own business as an individual.

All profits that you make after paying tax and national insurance will be entirely yours as a result. You do not establish a separate business entity with this structure, meaning that you will be personally responsible for any debts, business assets or liabilities.

-

Limited partnership – Choose this option if you would like to set up your own business with at least another person sharing the responsibilities of being self-employed.

Control and ownership of the business will be shared in equal measure between all partners. Just take note though that with this structure, each individual is required to submit a self-assessment tax return when declaring their personal income.

-

Limited liability partnership – Another option for creating a business with at least another person, though this structure requires your company to be registered with Companies House.

A limited liability partnership will see the business being legally separate from the individuals running it – ideal for peace of mind should a partner leave or your business runs into trouble. However, this structure requires quite a bit of admin work as each partner has to file their own estimated taxes, self-employed tax and personal income tax.

Registering as a self-employed tradesperson

How you go about registering as being self-employed will be determined by how you have structured your business from the options set out in the previous section.

If your business is based on you being either a sole trader or within a partnership, you will need to apply for a National Insurance number via GOV.UK if you do not already have one.

Ensure you also register for a self-assessment tax return. You must do this by October 5th in your second tax year.

Set up your business as a limited company though and you will be required to work through these initial steps:

-

Register an official company address.

-

Identify the nature of your business by deciding on a ‘Standard Industrial Classification (SIC) code’.

Insurance you may need when becoming a self-employed tradesperson

Another vital step as you become a self-employed tradesperson is to take out the correct and relevant insurance policies. These will protect you should something go wrong at your business and can even be legal requirements at times.

Have a think if you need these types of insurance at the company that you are setting up:

-

Employer’s liability insurance – A mandatory policy if you will be employing anyone at your business, even if it is a contractor or part-time member of staff.

This insurance protects you and your business should someone make a compensation claim due to an injury or an illness they develop at work.

-

Public liability insurance – Having this policy in place will cover you for the compensation fees and any legal costs if a member of the public sues your business for any personal injury or property damage they experience due to your work.

While not mandatory, some trade schemes require a business to have taken out this insurance before they will endorse a brand too.

-

Professional indemnity insurance – Another policy that is not mandatory, but one that you should definitely consider when you deliver clients with a professional service or recommendations.

This is because this insurance protects you financially if a client sues you if the customer feels they have suffered financial loss or damage due to an inadequate service or what they have deemed as being bad advice.

We hope this guide has clearly set out the first steps for you to take on your journey to becoming a successful self-employed tradesperson.

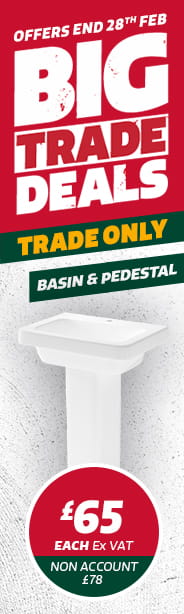

Don’t forget that we can provide you and your new business with a wide variety of top-quality tools and building materials as you get your firm off the ground too. Open a trade account and you will also be able to save money with access to trade only prices, receive free delivery to your local Travis Perkins branch and enjoy many more benefits that you will appreciate as you run your own company.

Disclaimer: Information displayed in this article is correct at the time of publication, but note that legislation changes periodically. The information contained on this page is intended as an overall introduction and is not intended as advice from a professional. Travis Perkins aims to avoid, but accepts no liability, in the case that any information stated is out of date.